Carbon Management

Meeting the continuous growth in energy demand while reducing emissions and mitigating climate change is a complex challenge that will require significant technology advancements, effective and coordinated energy policies and targeted capital investments.

We recognize the challenge in front of us and, as an industry-leading midstream operator, we are committed to being part of the solution. As most forecasts suggest, we believe that achieving a low-carbon economy will require all forms of energy, including oil and natural gas, for at least the next several decades. We also believe that understanding the critical role of energy in society and the various emissions reduction pathways can help our industry identify and implement effective climate change solutions without sacrificing economic and humanitarian imperatives.

Approach

At Crestwood, we continue to focus on growing our business in a responsible manner. We utilize a strict set of standard operating procedures for emissions management that is realistic, practical and cost-effective. We remain committed to ensuring that all our assets are incorporated into our rigorous sustainability practices, and we are focused on continuing to deliver energy responsibly and sustainably using an authentic and transparent approach.

Key 2022 Achievements:

Governance

Our commitment to mitigating climate change risks extends to all levels of the organization, from front-line employees to the Board of Directors. Crestwood’s Board of Directors’ Sustainability Committee is responsible for overseeing our carbon management and climate strategies, as well as developing environmental goals that are tied to employee compensation.

We report our emissions to the Sustainability Committee quarterly through an internal multi-discipline Carbon Management Working Group that consists of leaders from our operations, environmental services and sustainability departments. The executive sponsors of this group include our chief operating officer and our president. The Board of Directors and the Sustainability Committee are also responsible for reviewing the results of our annual ERM process and providing oversight of our climate-related risks. For additional information, please see the Sustainability Strategy and Governance section.

To foster accountability for achieving our ESG goals across the entire company, we link sustainability key performance indicators to both executive and employee compensation.

| 2022 Environmental KPIs | Goal | Achieved |

| Methane Emissions Intensity Rate | 0.046% | 0.034% |

| Conduct LDAR on Facilities with Methane Emission Sources | 75% | 100% |

As part of our continued commitment to environmental stewardship, we have developed clear and measurable KPIs for 2023, including a new KPI focused on methane detection devices.

Climate Change Strategy

Our climate change strategy is focused on delivering solutions that meet or exceed all regulatory requirements, reducing the emissions intensity of our operations and mitigating the potential for fugitive and process emissions, while contributing to society’s need for affordable and reliable energy. Effectively managing our GHG emissions intensity, including methane, is a critical component of our overall strategy.

Carbon Management Plan

In January 2022, we published our first Carbon Management Plan, which outlines our planned, near-term emissions related goals, activities and strategies.

In early 2023, we updated the Carbon Management Plan (Plan) to show the significant progress made in 2022 on the key deliverables outlined in the Plan and maintained our authentic approach to carbon management, while responsibly and strategically growing our business.

Carbon Management: Eight Key Commitments

(Click on the plus to read more)

2022 Carbon Management Key Achievements

| Commitments | Key Achievements |

|---|---|

Annual GHG Intensity Reduction Annual GHG Intensity Reduction |

|

|

|

|

|

|

|

|

|

Scope 2 Emissions Scope 2 Emissions |

|

|

|

Carbon Acquisition/ Divestiture Protocol Carbon Acquisition/ Divestiture Protocol |

|

|

|

Continuous Methane Emissions Monitoring Continuous Methane Emissions Monitoring |

|

|

|

Responsibly Sourced Gas Responsibly Sourced Gas |

|

|

|

Investment in Emissions Data Collection Investment in Emissions Data Collection |

|

|

|

Investment in Climate Technology Investment in Climate Technology |

|

|

|

|

|

|

|

|

|

Assessing and Managing Climate Risk

Understanding, managing and reporting on climate-related risks and opportunities is critical for our business. We integrate climate-related considerations into key business planning and decision making and incorporate these considerations into our annual ERM process. It is the responsibility of our executives and management team to implement this risk assessment and management process. To learn more about how we identify and manage climate-related risks, please see the Risk Management section.

In alignment with TCFD, we consider both physical risks – those associated with physical impacts from climate change – and transition risks – those that stem from regulatory, economic, market, technological and other societal changes associated with the transition to a lower-carbon economy.

Transition Risks

We have outlined our identified transition risks below and provided a brief description of the potential financial impacts and mitigation strategies associated with those risks.

| Type of Risk | Climate-related Risks | Potential Financial Impacts | Mitigation Strategies |

|---|---|---|---|

| Policy and Legal | Carbon policies and regulations including carbon pricing | Increased price of natural gas and higher operating costs | Engage with trade groups and policy makers; reduce CO2e emissions intensity across footprint to minimize the financial burden and meet regulatory requirements |

| Regulation monitoring and limiting GHG emissions | Increased complexity in maintaining permits and acquiring new permits | ||

|

Regulation that bans or limits hydraulic fracturing |

Restricted supply and increased price of natural gas | ||

| Comprehensive climate change legislation in the U.S. | Increased compliance and operating costs | ||

| Lobbying efforts against institutional investors toward fossil-fuel industry | Decreased company valuation | ||

| New environmental regulatory and reporting requirements | Increased compliance and operating costs | ||

| Reputational | Public sentiment shifting away from fossil-fuel producers | Reduced demand for oil and gas | Corporate governance and transparency; continued engagement with communities; advocacy |

| Market | Unfavorable ESG reviews of our company or industry by third parties | Decreased company valuation | Continued engagement with trade groups, industry peers, and investors; advocacy; transparency |

| Investor and lender sentiment shifting away from the fossil-fuel industry | Reduced demand for oil and gas and lower company valuation |

Climate-related Physical Risks

In 2022, we engaged with a third party to conduct a TCFD-aligned physical risk assessment of Crestwood’s top revenue generating assets. The purpose of the assessment was to consider and better understand how our business might perform under different future states and to prioritize protection against and adaption towards probable natural hazard scenarios to our properties and business.

The assessment evaluated the exposure of 11 sample Crestwood locations/assets to a specific natural hazard within the framework of climate change impacts based on various models, including government hazard models and National Oceanic and Atmospheric Administration (NOAA) climate change projections, as well as other models and projections. The hazards utilized in the assessment included:

Our operations team reviewed the hazard findings and the recommended mitigation and adaption strategies and determined that Crestwood has a high level of resiliency to the assessed physical risks. We acknowledge that we will need to take these physical risks, and others that emerge over time, into consideration for our overall business strategy.

Risk Assessment Findings

A summary of the physical risk assessment findings, including a description of each scenario evaluated, risk descriptions, potential business impacts and mitigation strategies, are listed below.

| Scenarios | Potential Financial Impacts | Mitigation Strategies |

|---|---|---|

|

Flooding/Hurricanes |

|

|

|

Polar Vortex |

|

|

|

Lightning |

|

|

|

Wildfires |

|

|

Emissions Performance

While operational emissions from midstream companies represent a small portion of total GHG emissions across the value chain, we believe it is our responsibility to proactively limit the environmental impacts of our operations as much as possible.

In 2022, our GHG intensity rates increased due to the acquisitions of Oasis Midstream and Sendero Midstream assets and the acquisition of First Reserve’s 50 percent interest in Crestwood Permian Basin Holdings LLC (CPJV), which resulted in the assets no longer being reported as a joint venture entity. In addition to the increases associated with the acquisitions, our absolute GHG emissions also increased due to legacy system expansions and increased throughputs.

Our methane intensity rate decreased by 5 percent from 2021 levels, 58 percent from 2018 levels and was 26 percent lower than our 2022 KPI goal that is tied to employee compensation.

We immediately took action to detect and reduce emissions from the newly-acquired assets, which included three gas processing plants, one crude stabilizer and terminal and 17 compressor stations. Within 180 days of acquisition, we performed methane detection flyovers on each asset, and we installed continuous methane detection devices on the Oasis Midstream assets in North Dakota.

Our divestitures conducted in 2022 did not provide any reductions to our emissions performance.

We are resolute in our efforts to reduce our emissions intensity as we responsibly grow our business through strategic acquisitions and continue to help meet increasing demand for reliable and affordable energy.

Timeline: Incorporating Acquired Assets into our Carbon Managment Practices

Emissions Performance

Methane Emissions Waterfall (mT)

| Methane Emissions (mT) | |

| 2021 Total | 2,439 |

| Divestitures | -533 |

| Legacy CEQP | -100 |

| Acquisitions | 1,184 |

| 2022 Total | 2,991 |

Total Scope 1

| 2020 | 2021 | 2022 | |

| Year | 819,235 | 746,623 | 1,100,297 |

Emissions Intensity Rates: 2020-2022

Metric Tons CO2e/$MM Adjusted EBITDA

Metric Tons CO₂e/$MM Adjusted EBITDA

| 2020 | 2021 | 2022 | |

| Metric Tons CO₂e/$MM Adjusted EBITDA | 1,972 | 1,602 | 1,851 |

GHG Emissions Breakdown by Equipment Source

2020

| Source | Metric Tons CO2e |

| Compressor | 23,644 |

| Fuel Combustion | 598,785 |

| Combustion Control Device | 82,955 |

| Amine Treater | 38,993 |

| Dehydrator | 36,552 |

| Heater | 2,302 |

| Pneumatic Controllers | 17,491 |

| Pneumatic Pumps | 5,319 |

| Trucking Emissions | 12,948 |

| Fugitives | 7,479 |

Advancing Methane Emissions Detection

Reducing our methane emissions and capturing marketable methane through safe, reliable and efficient operations is a critical part of our sustainability strategy and Carbon Management Plan. Where feasible, we use various types of controls and equipment at our facilities to minimize methane emissions.

Leak Detection and Repair

Detecting and repairing methane leaks is vital as we test and deploy new methods to mitigate methane emissions. We rely on a variety of tools and techniques as part of our well-established LDAR process. Each of these technologies has a specific application and purpose.

Continuous Methane Monitoring

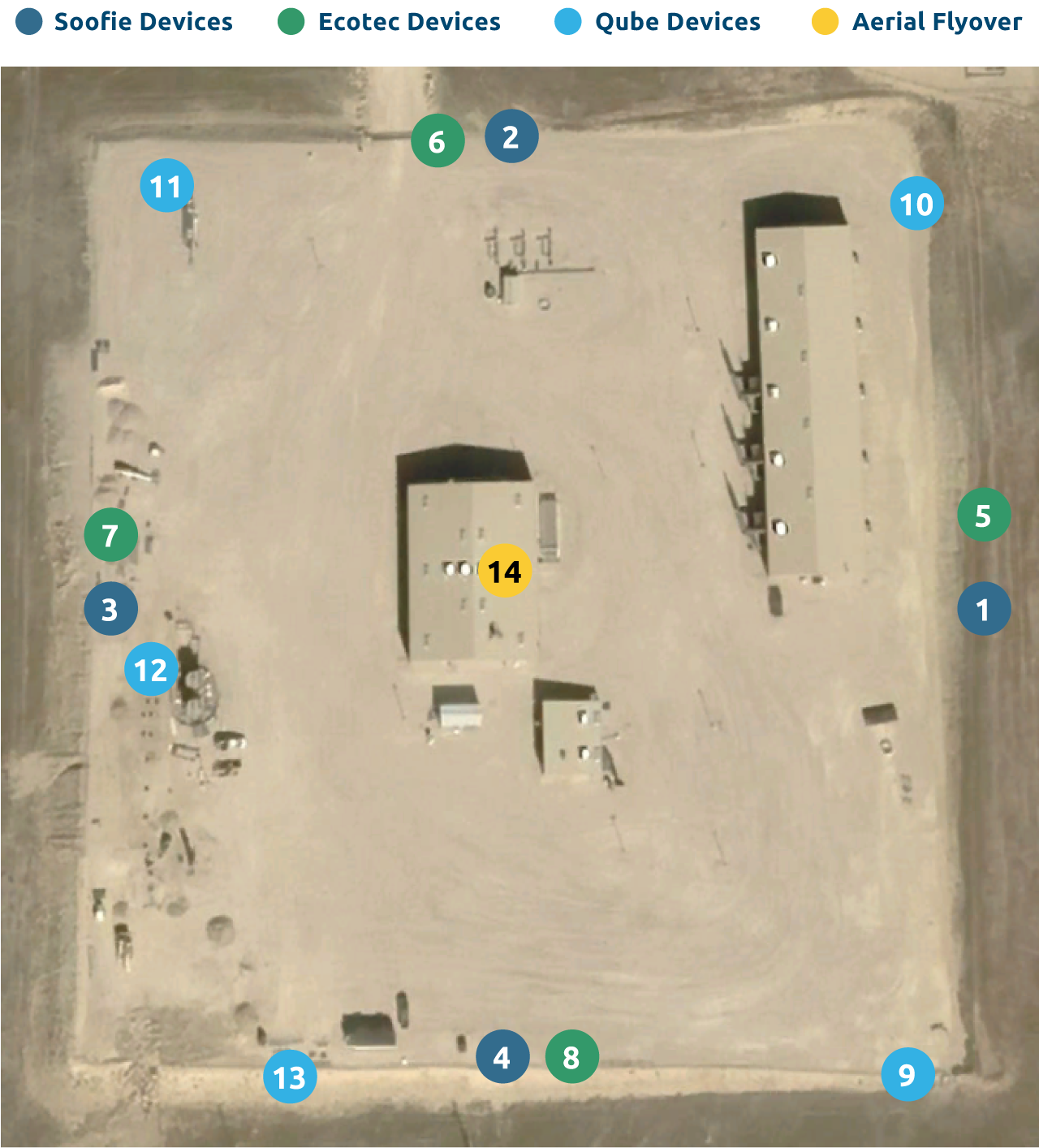

Rigorously evaluating and effectively implementing new methane detection technology is a key component of our methane reduction efforts. In 2022, we piloted three different next-generation continuous monitoring applications at 13 percent of our facilities as part of our ongoing effort to find more robust and faster ways to detect and mitigate emissions.

Based on the results of the pilot program, we aim to deploy continuous methane emissions monitoring devices at 40 percent of our compressor facilities in 2023 and 100 percent by 2024. Moving forward, two of the three continuous monitoring applications will be used to evaluate alternate technologies for our processing facilities and compressor stations.

Methane Emissions Test Facility

In 2022, Crestwood established an emissions monitoring test facility – the Appaloosa compressor station on our Jackalope System, located in Wyoming. Appaloosa has played a critical role in helping us identify which technologies are most effective and can be incorporated more broadly across Crestwood’s various assets.

To date, we have implemented OGI cameras, our LDAR program, flyovers and testing of all three next-generation continuous methane monitoring technologies at Appaloosa. As a result, our detected methane emissions decreased by 87 percent during the first five months of the pilot project.

Quantification, Monitoring, Reporting and Verification (QMRV) Project

In 2022, we joined the Cheniere Energy-led QMRV project with several other midstream operators, methane detection technology providers and leading academic institutions to better understand the methane emissions associated with the operation of natural gas gathering, processing, transmission and storage systems.

The QMRV project develops and employs multi-scale, multi-technology measurement methodologies including ground, drone, aerial and satellite, along with robust assessments of operational and maintenance practices, to develop dynamic, measurement-informed methane inventories of facilities. Crestwood enrolled three of our assets in the project beginning in 2021.

We believe that participating in industry initiatives like the QMRV project is important and further demonstrates our dedication to better understanding our emissions, while also testing innovative methane detection technologies. We will continue to look for additional opportunities to fully understand and quantify emissions across our value chain so that we can more effectively reduce them.

Emissions Management Collaboration

As a company, we actively participate in several voluntary initiatives aimed at reducing GHG emissions across our industry. We believe that coordination, collaboration and sharing best practices increases innovation and helps us develop more effective solutions. Our employees not only participate in collaborative industry efforts, but they chair committees and, in some cases, hold Board positions.

ONE Future

Crestwood has been an active and collaborative member of ONE Future since 2020 and our senior vice president for ESG and corporate communications sits on the Board. We continue to meet and exceed the ONE Future methane emissions targets for both the Gathering & Boosting and Processing segments.

| Gathering & Boosting | Processing | |

|

|

0.080% | 0.111% |

|---|---|---|

|

|

0.0378% | 0.0285% |

The Environmental Partnership

In 2022, we continued our membership and participation in The Environmental Partnership, a group of energy companies focused on technically feasible, commercially proven solutions to reduce emissions.

For more information about The Environmental Partnership goals and our progress meeting them, see the Carbon Management section of our 2021 Sustainability Report.

Case Study

Operational Excellence: Herradura Compressor Station

Read More

Read MoreLooking Ahead

Our focus in 2022 was to set a strong foundation for our carbon management efforts, with an emphasis on data management. In 2023, we plan to continue building upon that foundation by:

- Developing a dedicated ESG budget to further reduce emissions intensity at our highest emitting assets, focusing on efforts that will produce the greatest reduction in emissions

- Annually identifying and prioritizing facilities where modifications will lead to reduced emissions

- Deploying continuous methane monitoring devices across 40 percent of our compressor facilities by year end, with plans to reach 100 percent by 2024

- Concluding the Cheniere-led QMRV project and incorporating lessons learned

- Continuing to expand our emissions digitization initiative focused on improving the accuracy and availability of our emissions data

- Exploring the development of an internal cost of carbon and integrating it into project valuations, equipment selection and retrofits

- Staying abreast of RSG market developments in the midstream industry and engaging with key customers on potential RSG partnerships

For additional information on how we manage emissions, please see the following documents:

Industry and Trade Group Participation and Leadership

Industry and Trade Group Participation and Leadership

ONE Future Target

ONE Future Target